Modern Monetary Theory

Should you adhere by FIRE, 50/30/20, or only listen to Dave Ramsay’s advice? What about “Passive Income”? How much money should you save? How much money should you spend?

In every financial decision we make we aren’t justifying the decision via some sort of underlying philosophy. We evaluate the costs and benefits, quickly analyze whether it’s in our budget, and either pull the trigger — or don’t.

What’s so fascinating about this subject is the fact that so many Millennials & Gen Z’ers are blindly accepting this new modern “frugal” mindset. We’ve become more knowledgable about our finances and that somehow dictates that we have to put 20% of our income towards savings and max out our IRA contribution.

In order to reach the promised land they say, one must sacrifice their 20s. Cutting out that Starbucks coffee, living in that shitty apartment or with your parents, and not buying a new car (Okay fine, I actually endorse this one).

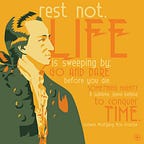

And yet, it seems to me, we are all missing the bigger picture.

We should, in every day of our lives, optimize our pleasure curve in relation to these five fundamental assumptions. These assumptions should dictate the philosophy of how you spend and how you save.

(Warning: Some of these will be morbid)

- You are going to die and you don’t know when. This most likely means, that when you do actually die, the potential value or opportunity cost of all your unrealized income and assets are instantaneously eliminated. So if you’re planning to be a millionaire by 40 and travel the world but die at 39 — well, you’re shit out of luck.

- The future will be better than now. The future will be more progressive than now. The future will be more technologically advanced than now. I think history bears this fact out quite well. Odds are, in the future, the social safety nets that government provides will be better. Not only that, technology will not only be better — but it should be cheaper as well. That means that in the worst case scenario — let’s say you’re in a mountain of debt and are homeless. You simply declare bankruptcy and live off welfare. Millions of Americans are already doing it (Not to say that it is desirable, but to say that you can survive pretty well). And with the technological advances at that time in the future, you would likely be better off than the average person was in the 80s and 90s.

- Your Parents will die. So, unless you have a gazillion siblings. You’ll most likely inherit some of their assets. The house, the car, their money. And if they have a life insurance policy — you’ll get that too. Of course, hopefully this won’t happen until you’re very old — but at the very least, this means that the wealth should be there for your own children.

- When you are in your 20s and 30s, you are in the prime of your life. Your physical prime certainly & most likely your mental prime. Some of you will be totally free of obligations (kids) and more inclined to explore/move around. One should know that this opportunity isn’t to be wasted.

- You probably have friends who would be willing to help you out when in a sticky situation. Your friends shouldn’t serve as your primary safety net, but in a sense, they are a safety net. They can help you find a job. They can house you temporarily. They can give you an interest free loan. You can leech off their subscription services.

Please note, this does *not* mean I am justifying pure idiocy. Yes, max out your 401k contribution. Yes, have an emergency savings account. Yes, don’t live above your means. Yes, do not rack up astounding amounts of debt. Yes, invest your money (in an index fund tracking the S&P 500 preferably).

But, if you ask me — would I rather go on a Vietnam adventure with my friends when I’m 25 or invest the monetary equivalent. I say, buy the plane tickets.